Managing a business is a multifaceted endeavor, and one of the most crucial aspects of it is understanding how to pay employees. This process involves much more than just writing checks or transferring funds. It’s a complex system that includes a deep understanding of labor laws, tax regulations, and accounting practices.

This guide will lead you through the intricacies of paying employees properly, from the various methods available to the importance of doing it correctly. Whether your business has just formed or you’re looking to streamline an existing process, we will provide valuable insights that will assist you in making informed decisions.

On top of this, we’ll review key features to look for in payroll software to help you make the best choice for your business. Beyond these aspects, this guide will also introduce a comprehensive payroll solution that combines all these factors into one seamless system.

By mastering how to pay employees correctly, you can ensure your business operates smoothly, and your team remains motivated and content.

How to Pay Employees

To successfully manage your employees’ compensation, there are several critical steps to follow. These steps will guide you in calculating the correct employee pay while ensuring that all legal requirements and regulations are met.

Step 1: Determine the employee’s hourly rate or salary

The first step in the process of paying an employee is to determine their pay structure. Are they hourly workers or salaried employees? For hourly employees, you’ll need to know their hourly wage. For salaried employees, you will need to determine their annual salary, which can be broken down into a per-pay-period amount based on your payroll frequency (weekly, bi-weekly, monthly, etc.).

Step 2: Calculate regular hours worked

Next, you’ll need to calculate the regular hours the employee worked during the pay period. This is generally straightforward for hourly employees, as their pay is directly tied to the number of hours they work. For salaried employees, you’ll want to ensure they are meeting their agreed-upon work hours.

Step 3: Calculate overtime hours worked

If you have hourly employees who have worked more than 40 hours in a week (according to federal law, though some state laws may differ), you’ll need to calculate the number of overtime hours worked. Overtime is typically paid at one-and-a-half times the regular hourly rate, though again, this can vary depending on state laws and company policy.

Step 4: Add any bonuses or other payments

On top of regular and overtime pay, employees may also receive additional compensation such as bonuses, commissions, or tips. These should be added to the employee’s total earnings for the pay period. Be sure to understand the tax implications of these additional payments, as they may be subject to different withholding rates.

Step 5: Subtract any deductions

The final step in the process of paying an employee involves subtracting any necessary deductions from their gross pay (the total calculated from steps 1-4) to determine their net pay. Deductions can include things like tax withholdings, Social Security and Medicare contributions, health insurance premiums, retirement contributions, and wage garnishments.

Methods for Paying Employees

When it comes to compensating your employees for their hard work, there are several methods available. Your choice will depend on a range of factors, including the size of your business, the nature of your workforce, and the regulations in your locale.

Direct Deposit

Direct deposit is one of the most common methods of paying employees in today’s digital age. This method electronically transfers an employee’s wage into their bank account, providing one of the most seamless payment methods.

Businesses often prefer direct deposit due to its convenience, speed, and security. It eliminates the need for physical checks and ensures employees receive their pay on time, regardless of holidays or unexpected events.

Additionally, direct deposit is generally more eco-friendly as it reduces paper waste. However, it does require that all employees have a bank account, which may not always be the case.

Paper Checks

Despite the rise of digital payments, many businesses still use paper checks in the modern age. Paper checks provide a physical payment record, which some employees and employers prefer.

They also don’t require employees to have a bank account, although cashing the check might be more challenging without one. The major downsides of paper checks include the cost of printing, the risk of loss or theft, and the delay in funds availability while the check clears.

Prepaid Cards

Prepaid cards are a relatively modern method of paying employees. With this method, an employer loads an employee’s wages onto a prepaid debit card. Employees can then use this card to make purchases, withdraw cash from an ATM, or even transfer funds to their bank account.

This method is particularly beneficial for employees without a bank account, providing them with a safer and more convenient way to receive and manage their money. However, ensuring that the prepaid card provider does not charge excessive fees is crucial, which could eat into employees’ hard-earned wages.

Cash Payments

Cash payments, while less common today due to logistical and security issues, are still used in certain circumstances. Cash might be suitable for small businesses with few employees or for casual labor.

Cash payments can be beneficial as they provide immediate funds to the employee. However, businesses using this method must be diligent about record-keeping to comply with tax obligations. Additionally, cash can be more prone to theft, loss, or counting errors, which can create additional complications.

The Importance of Employee Classification

Employee classification plays a vital role in determining how an individual is paid. This classification not only influences the employee’s salary structure but also has significant implications for tax purposes. Incorrectly classifying an employee can lead to serious consequences, including penalties from regulatory bodies.

Therefore, understanding the differences between hourly employees, salaried employees, commission-based employees, and independent contractors is paramount for any business owner.

Hourly Employees

Hourly employees are paid based on their actual work hours during a pay period. These employees are typically entitled to overtime pay if they work more than a specified number of hours per week, usually 40 in the United States, although this may vary by state.

It’s crucial for employers to accurately track the hours worked by these employees to ensure they are paid correctly and to comply with labor laws.

Salaried Employees

Salaried employees receive a set amount of money annually, divided into regular payments, typically bi-weekly or monthly. This salary is ultimately not dependent on the number of hours worked.

Salaried employees are typically exempt from overtime pay, meaning they receive the same pay regardless of working more than the standard number of hours a week. However, this depends on their job duties and salary level, which must meet certain criteria to be exempt under the Fair Labor Standards Act (FLSA) in the United States.

Commission-Based Employees

Commission-based employees are paid primarily or entirely based on the sales they make or the revenue they generate. This can be in addition to a base salary or on its own. In some industries, such as real estate or car sales, commission-based pay is standard.

Commission pay can be a powerful incentive for employees to perform, but it can also lead to income instability if sales fluctuate. Employers must comply with minimum wage laws, ensuring employees’ total compensation meets or exceeds the minimum wage.

Independent Contractors (1099)

Independent contractors, often called 1099 employees (named after the tax form they receive), are not technically employees but are self-employed individuals hired on a contract basis.

They are paid based on the contract terms, such as a flat fee, an hourly rate, or a project-based rate. Unlike employees, independent contractors are responsible for managing and paying their own taxes, including self-employment tax.

Hiring independent contractors can provide more flexibility and lower costs for the employer since they don’t have to pay benefits or payroll taxes. However, it’s important to correctly classify workers as employees or independent contractors, as misclassification can lead to legal issues and penalties.

The Best Way to Pay Employees

In the modern business environment, implementing an automated payroll system is the most efficient and accurate way to pay employees. Automated payroll software saves time and reduces the potential for human error, enhances compliance, and improves overall payroll management.

Automated payroll software is efficient because it streamlines the payroll process. It automatically calculates earnings, deductions, and taxes, reducing the amount of manual work required. It also allows for easy recordkeeping, making it simpler to track and report payroll information for accounting and tax purposes.

Automated systems are more accurate because they eliminate the risk of human error in calculations. They also stay updated on the latest tax laws and regulations, ensuring your business remains compliant.

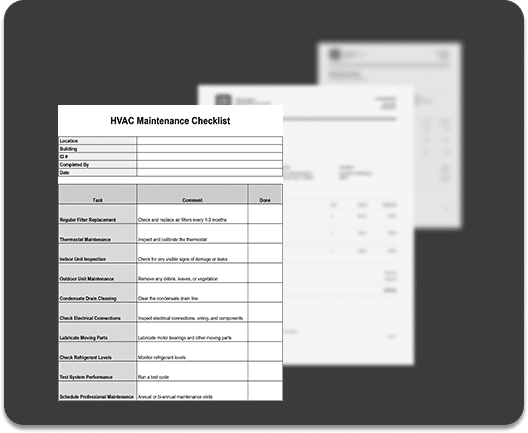

To successfully implement payroll software in your business, follow these basic steps:

- Assess Your Needs: Identify your needs before choosing a software solution. Consider factors like the size of your company, the complexity of your payroll (for example, if you have different types of employees), and the reporting features you need.

- Choose the Right Software: Numerous payroll software options are available, each with different features and capabilities. Compare different software options, considering their features, ease of use, customer support, and cost.

- Set Up the Software: Once you’ve chosen a preferred software solution, you’ll need to set it up. This usually involves entering your company information, setting up your payroll structure, and entering employee details. The software provider will usually offer guidance and support during this process.

- Train Your Staff: Ensure that the people who will be using the software are adequately trained. This may involve using the training resources provided by the software company, such as tutorials or webinars.

- Run a Test Payroll: Before running your first live payroll, do a test run to ensure everything is set up correctly. Check that all calculations are accurate and that all necessary information is included.

- Run Your Payroll: Once everything is set up and tested, you’re ready to run your payroll. With automated software, this should be a straightforward process of entering hours worked (if applicable), approving payroll, and then distributing pay to employees.

- Regularly Review and Update: Regularly review your payroll process to ensure it’s still meeting your needs and staying compliant with any changes in regulations. Also, update employee information as needed.

Key Features to Look for in Payroll Software

When it comes to choosing payroll software for your business, certain features are essential to ensure efficiency, accuracy, and compliance. Among these, accurate time and attendance tracking, automatic break and overtime calculations, and one-click payroll processing are particularly important.

|

Feature |

Benefit |

|

Accurate Time & Attendance Tracking |

This feature automates the process of tracking employees’ working hours, reducing the risk of errors associated with manual data entry. Accurate time tracking is crucial for businesses with hourly employees, as it directly impacts their pay. Moreover, it provides valuable data for workforce management, helping you understand staffing needs and employee utilization.

|

|

Automatic Break & Overtime Calculations |

This feature automatically calculates break times and overtime hours according to the rules set in the software. This saves time and ensures compliance with labor laws regarding break times and overtime pay. It removes the burden of manually calculating these amounts, reducing the potential for costly errors and disputes. |

|

One-Click Payroll Processing |

Once all data is entered and verified, one-click payroll processing allows you to run payroll with a single click. This feature greatly simplifies the payroll process, saving time and reducing the possibility of delays in employee payment. It can also automate tax calculations and deductions, further reducing the workload and ensuring accuracy.

|

By ensuring that your payroll software includes these features, you can improve the efficiency of your payroll process, increase its accuracy, and maintain compliance with labor laws.

Remember, a good payroll system is an investment that will pay off in the long run by saving you time and preventing costly errors.

Eliminate Payroll Errors with Workyard

Workyard offers a comprehensive solution for all your payroll needs. The company’s robust software integrates seamlessly with popular accounting systems like QuickBooks, Foundation Software, and MYOB, facilitating accurate and efficient payroll management.

Workyard’s time tracking feature ensures that the hours your employees work are accurately recorded, thereby eliminating guesswork and discrepancies. This feature particularly benefits businesses with remote workers or multiple job sites, providing real-time insights into your workforce’s activity.

With Workyard, you can automate payroll and the complex calculations associated with it, including overtime and breaks, significantly reducing the risk of errors. Additionally, Workyard allows for easy adjustments and corrections, ensuring that any changes in an employee’s work hours are accurately reflected in their pay.

This comprehensive solution provides the peace of mind that your payroll process is accurate, compliant, and efficient.

Ensuring Employees Are Paid Properly

Learning how to pay employees effectively is critical to running a successful business. It involves choosing the right payment method, accurately classifying employees, and implementing an efficient payroll system. By paying careful attention to these factors, you can ensure that your employees are compensated correctly and on time, helping to foster a positive working environment.

Automated payroll software, such as Workyard, can greatly simplify this process. With features such as accurate time and attendance tracking, automatic break and overtime calculations, and one-click payroll processing, Workyard takes the guesswork out of how to pay employees. It not only enhances accuracy and efficiency but also helps ensure compliance with labor laws.

Ready to transform your payroll process? Sign up for a free trial of Workyard today and discover how easy it can be to pay your employees accurately and efficiently.

Workyard has the tools to streamline your payroll process and eliminate errors, whether you’re a small business owner or manage a large workforce. Don’t let payroll complications stand in the way of your business’s success — try Workyard today.