The Reserve Bank’s Monetary Policy Committee has its final meeting for the year on Wednesday, and then they shut up shop. For a long time. The next scheduled announcement is not until 22 February, a full 13 weeks (3 months) away. Nice job if you can get it, and although I’m sure management and staff will still be working for much of the intervening period, the same is unlikely to be said for the three non-executive members, who are generously remunerated by the taxpayer, utterly invisible, and only need to show up when meetings are scheduled.

This strange schedule has been in place for quite a few years now, having been adopted at a time when the OCR wasn’t being moved much at all (and when the Bank was raising the OCR, it often proved to have been a mistake). But having been in place for a while does not make it any more defensible or sensible. In fact, last year’s three month summer break almost certainly was one factor in how slow the MPC was to get on with raising the OCR once they’d finally made a start. On no reading of the data (contemporary data that is) did it make sense for us to have ended 2021 with the OCR still lower, in nominal terms, than it had been just prior to Covid. And having experienced the issue last summer (when perhaps it caught them by surprise) there was no excuse for not resetting the schedule for this summer.

One can always mount defences (for almost anything I suppose). Monetary policy works with a lag, the OCR adjustments can be just as large as they have to be, perhaps there is a bit of a tradeoff between time doing analysis and time spent preparing for meetings. But none of it is very convincing in this context. And it is out of step with their peers.

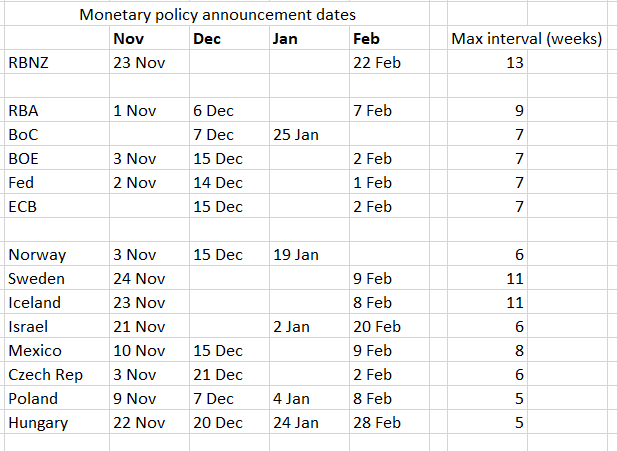

Here is a table of the monetary policy announcements dates over November to February for a fairly wide range of OECD country central banks. None, not even Sweden and tiny Iceland, are taking as long a break as our MPC (and although I didn’t tot up all the northern hemisphere summer meeting dates, it didn’t look as though any took as long a break then as our MPC takes now). The median country has a longest gap of seven weeks between meetings over this period.

[UPDATE: In addition, the South Korean central bank meets on 24 Nov, 13 Jan, and 23 Feb]

There are substantive macroeconomic arguments for (and against) a 75 basis point OCR adjustment this week, but one of arguments some have advanced is that they really need to go 75 basis points this week because they don’t have another opportunity until late February. But whose fault is that? It is entirely an MPC choice. They have a very flexible instrument and just choose to tie their hands behind their backs to give themselves a very long summer break.

The whole situation is compounded by the inadequacies of New Zealand’s key bits of macroeconomic data. We now have the CPI and the unemployment rate for mid-August (the midpoint of the September quarter). Most OECD central banks already have October CPI data, almost all have September unemployment rate data (and several have October unemployment rate data), and three-quarters of OECD countries already have September quarter GDP data (a few even have monthly GDP estimates).

The combination of slow and inadequate data and widely-spaced summer meetings really isn’t good enough, especially at a time when there is so much (perhaps inevitable) uncertainty about the inflation situation and outlook. The inadequacies of our national macroeconomic statistics cannot be fixed in short order (not that the government shows any interest in doing so anyway). But how often, and when, the MPC meets is entirely at the Committee’s discretion, and easily altered with little or no disruption other than to the holiday plans of some appointed and (supposedly) accountable policymakers (people who not incidentially – and pardonably or otherwise – have done such a demonstrably poor job of their main responsibility, keeping core inflation in the target range, in recent times.

The MPC should be announcing on Wednesday (a) an extra OCR review for a few days after the CPI release in January, and (b) a commitment to revisit the meeting schedule for future years to bring the length of the long summer break back to (say) no longer than the one the RBA takes. If they don’t journalists at the press conference and MPs at FEC should be asking why not.

(Writing this post brought to mind memories of Orr 20+ years ago when the OCR was first introduced championing having only four reviews a year. The OCR then was new, inflation was low and stable. One hopes that sort of thinking no longer lurks in the back of the Governor’s mind.)