The Oregon School District’s Board of Education unanimously approved two tax levies at their Monday, Oct. 24 meeting to prepare for the outcome of the Nov. 8 election, which includes a ballot question regarding the district’s $11.4 million operational referendum.

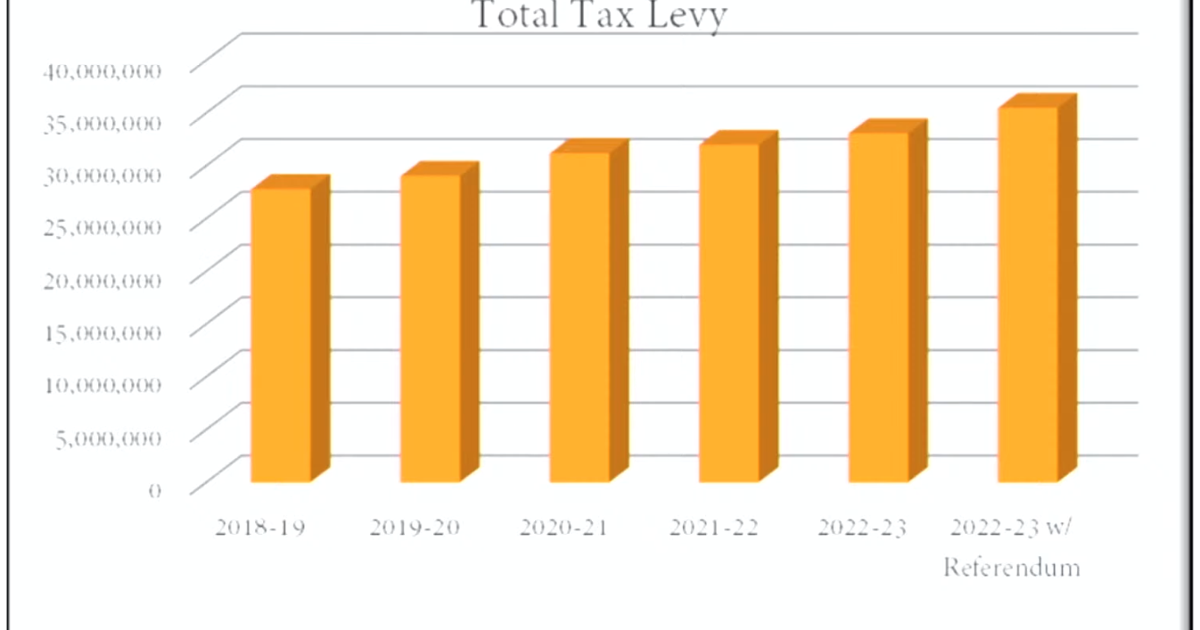

If the referendum fails, the total school tax levy would be $33,093,824. If the referendum passes, it would be $35,513,824. OSD Business Administrator Andy Weiland noted that the percentage increase from last year’s tax levy will be a 3.43% increase with the referendum’s failure or a 10.99% increase with its success.

Weiland also emphasized the budgets’ mill rates. The mill rate is used to calculate property tax liability. Weiland indicated that with assessment values across the state increasing overall, the impact of the referendum might be a bit less than was predicted on OSD’s informational materials.

“I want to point this out: you can see that the mill rate from last year was $10.40. It would drop to $9.37 [without the referendum.] So that’s a little over a 10%… decrease,” Weiland said. “With the referendum passing… you actually still see a reduction of around 3% of the mill rate going from $10.40 to $10.06.”

Weiland and Board of Education Vice President Tim LeBrun stressed that the tax impact will ultimately vary from household to household.

“I think that’s what points to how confusing school finance is,” President Krista Flanagan said in regards to Weiland and LeBrun’s reminder. “It’s just not like a budget that you have at home, where you know exactly what money is going into one account and going out another, and you have your investments or whatever… There are all these variables based on where you live… We’re trying to make something that is super complex a little bit easier for people to understand.”